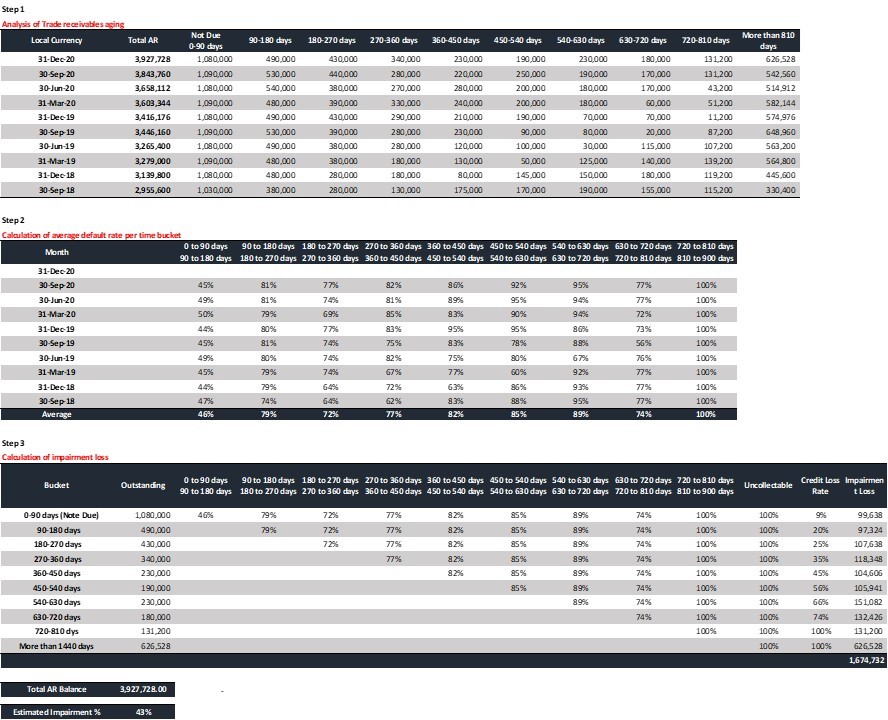

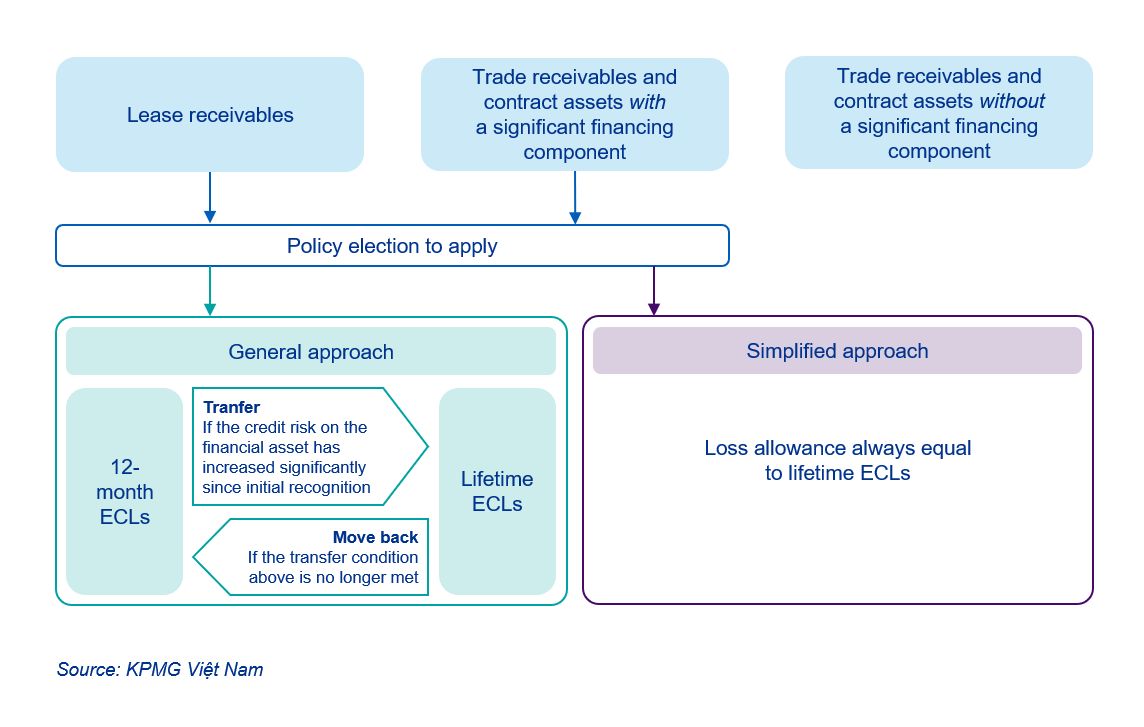

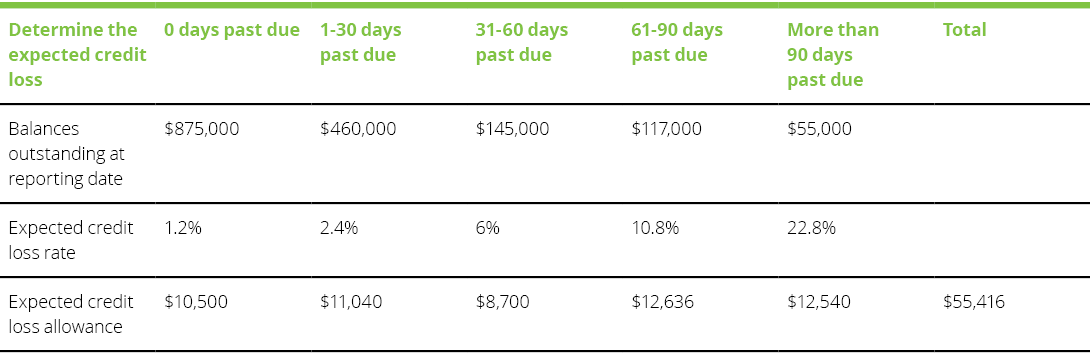

IFRS 9 para 5.5.15 simplified approach for trade receivables and contract assets, disclosures for receivables and contract assets and liabilities – Accounts examples

IFRS 9, simplified approach for trade receivables, policy, judgements and estimates and disclosures including credit risk – Accounts examples

IFRS 9 para 5.5.15, simplified approach for impairment of trade receivables, IFRS 7 paras 35A-N, certain disclosures – Accounts examples

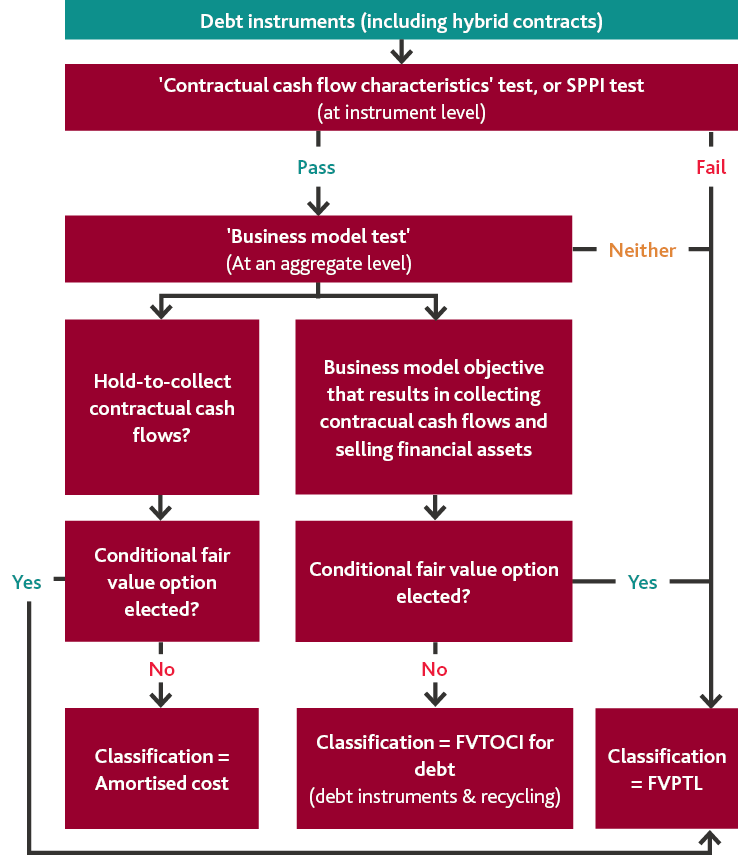

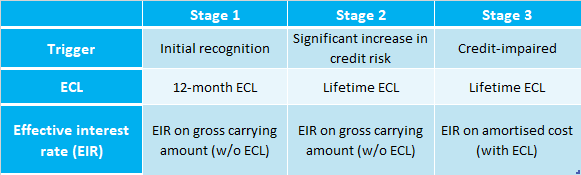

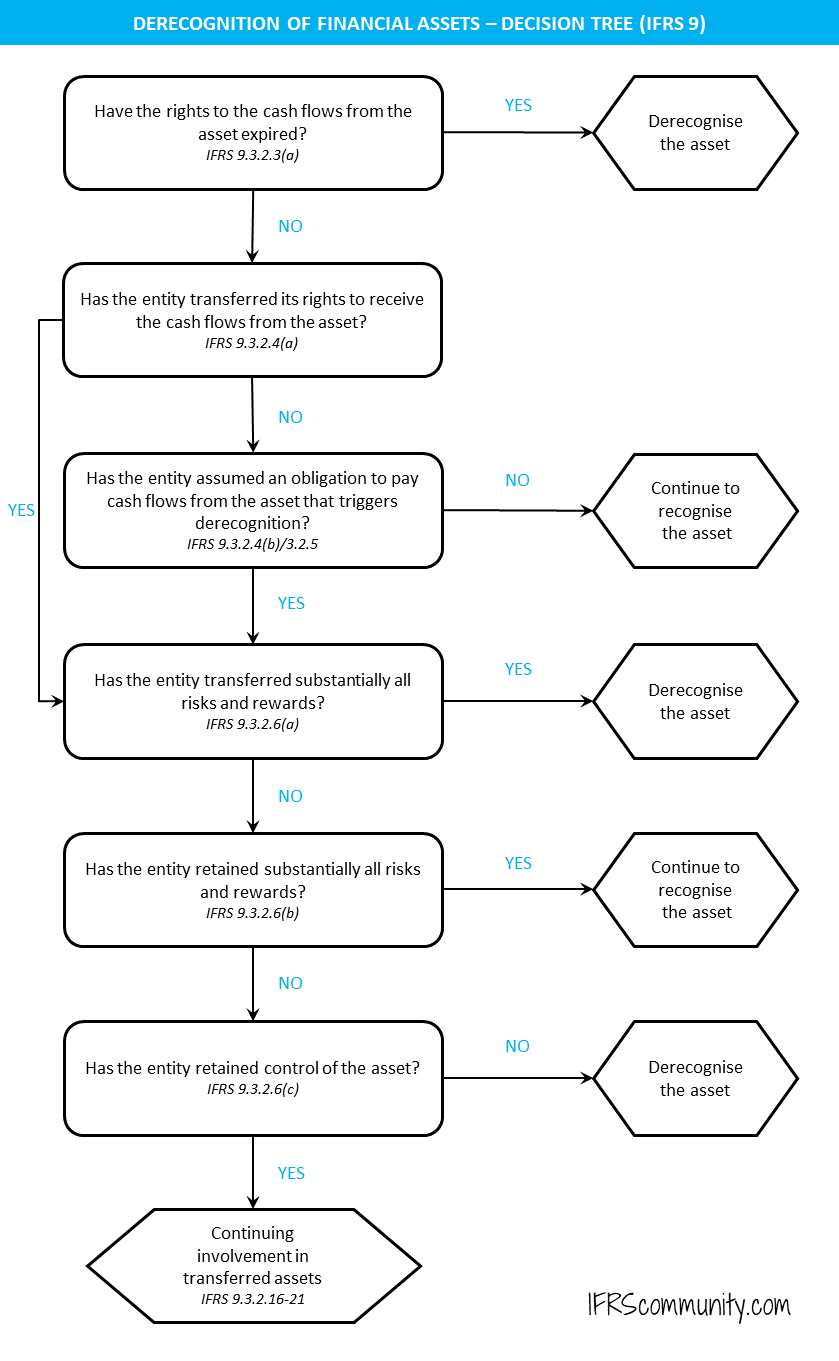

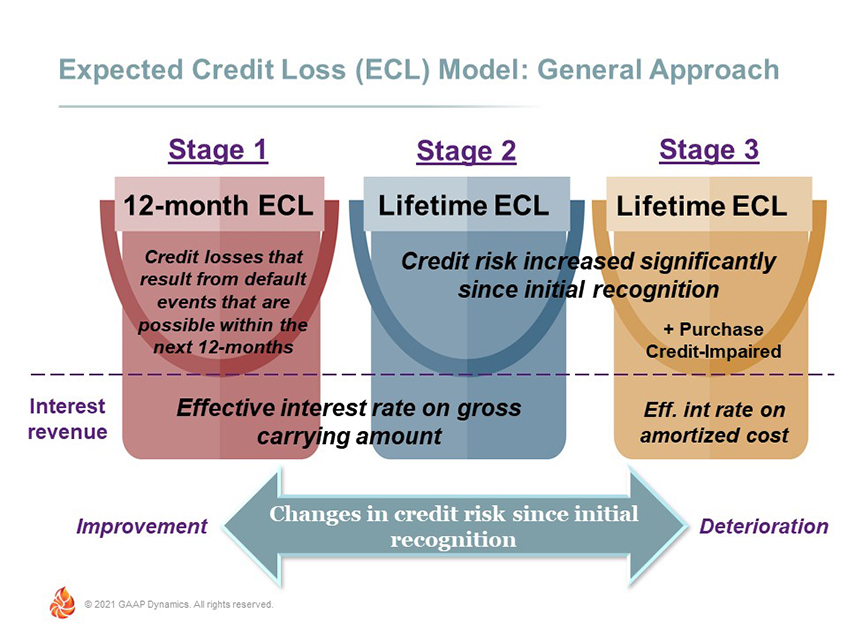

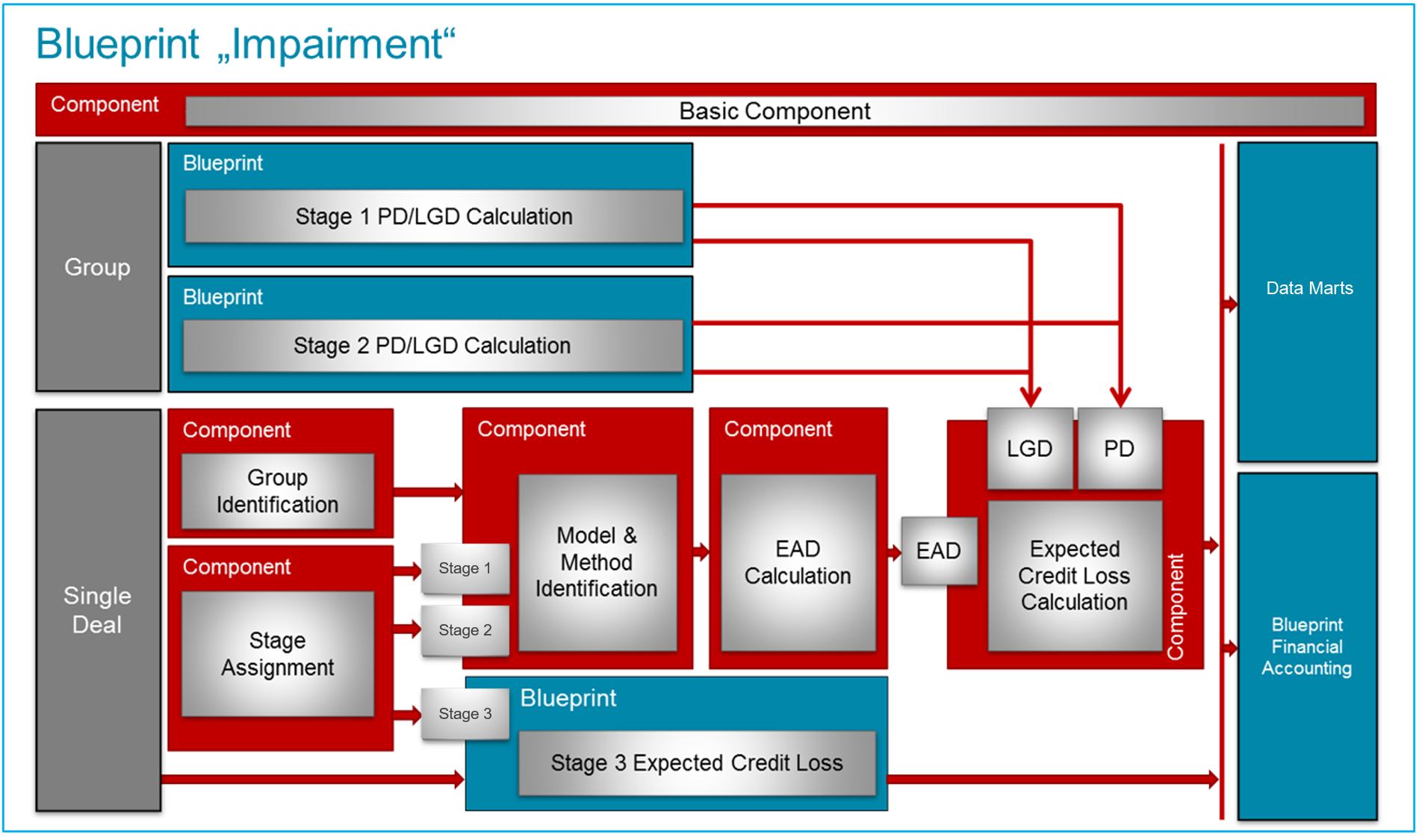

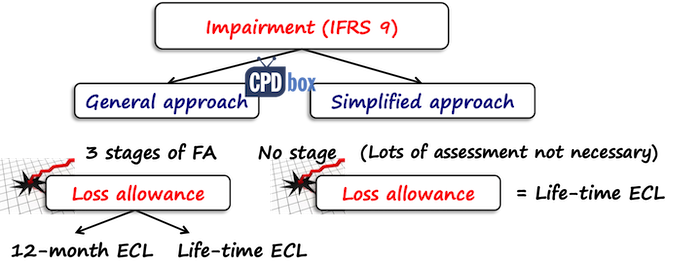

IFRS 9 — new approach to classification and impairment of financial assets - Korpus Prava.Publications

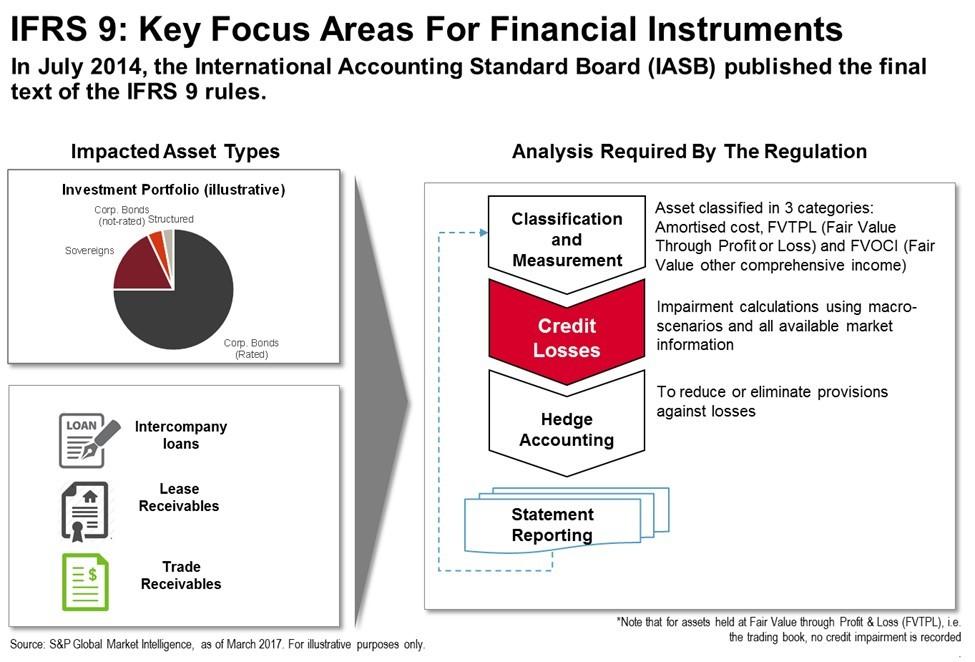

IFRS 9 Impairment How It Impacts Your Corporation And How We Can Help | S&P Global Market Intelligence

IFRS 9, simplified approach for trade receivables, policy, judgements and estimates and disclosures including credit risk – Accounts examples

IFRS 9 para 5.5.15 simplified approach for trade receivables and contract assets, disclosures for receivables and contract assets and liabilities – Accounts examples